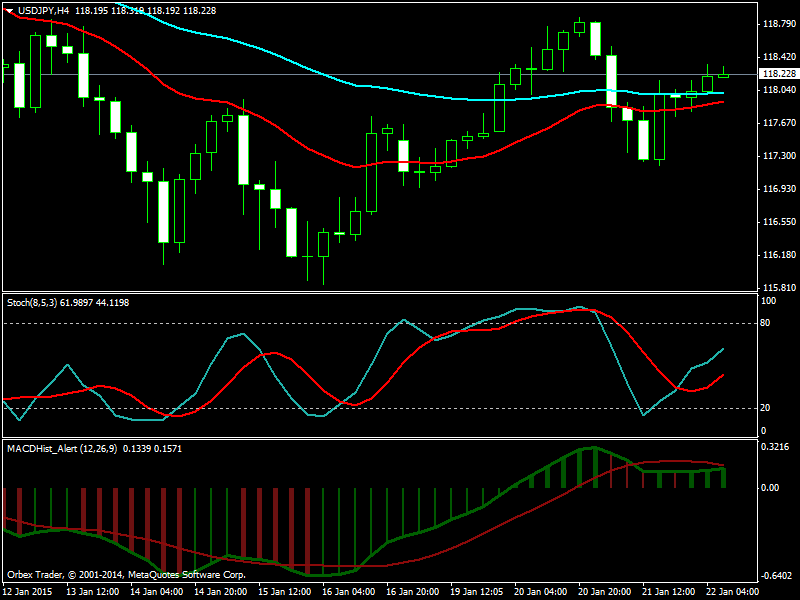

Is USDJPY primed for a record low? Well this is precisely what the Japanese margin traders are betting right now. Take a look at the most recent USDJPY chart below.

A strong bearish divergence pattern looks like in the making. Margin traders in Japan raised bets the yen would fall against the dollar to a record amid their currency’s best start to a year since 2010.

So you can expect USDJPY to fall to a record low. Keep this in mind, financial markets work on the principle of expectations. Expectations are far more strong a signal as compared to the actual reality. When the people start expecting inflation to rise, it will rise. This is what Econ 101 teaches. In the ame manner, when the market starts thinking that this currency or this stock is going to fall, it will fall. This is how the financial markets and the economies work.

A weak Yen is what the Bank of Japan wants so what the market is expecting is precisely what the Bank of Japan wants. Swiss National Bank has made the job of Central Banks more challenging as markets are not willing to believe what the Central Banks say in their public announcements. Swiss National Bank had announced just last month that it will defend the 1.20 Swiss franc to 1 euro peg at all costs. Then it suddenly made an about face and removed the peg. This makes things difficult for the bank of Japan as it will have to put more stimulus in the economy to fight deflation .