Bitcoin is daily making headlines. Yesterday Bitcoin price breached $19K mark on one of the exchanges Coinbase. On other cryptocurrency exchanges, Bitcoin price made a high just above $17K and then just a few hours later Bitcoin price plummeted to around $14K ( a drop of 14% in just a few hours). In just one year Bitcoin has made tremendous gains. It started this year with a price below $1K and is ending the year with price touching $20K. Enthusiasts are making big and bold claims and seeing bitcoin touch $100K mark by the end of next year. There are some who are even seeing bitcoin touching $1 million. On the other hand, critics think that bitcoin is a bubble. I wanted to write a post on bitcoin. In this post I will discuss bitcoin in depth and see what we can do with it as day traders. Did you watch the documentary on the day in the life of a millionaire forex trader.

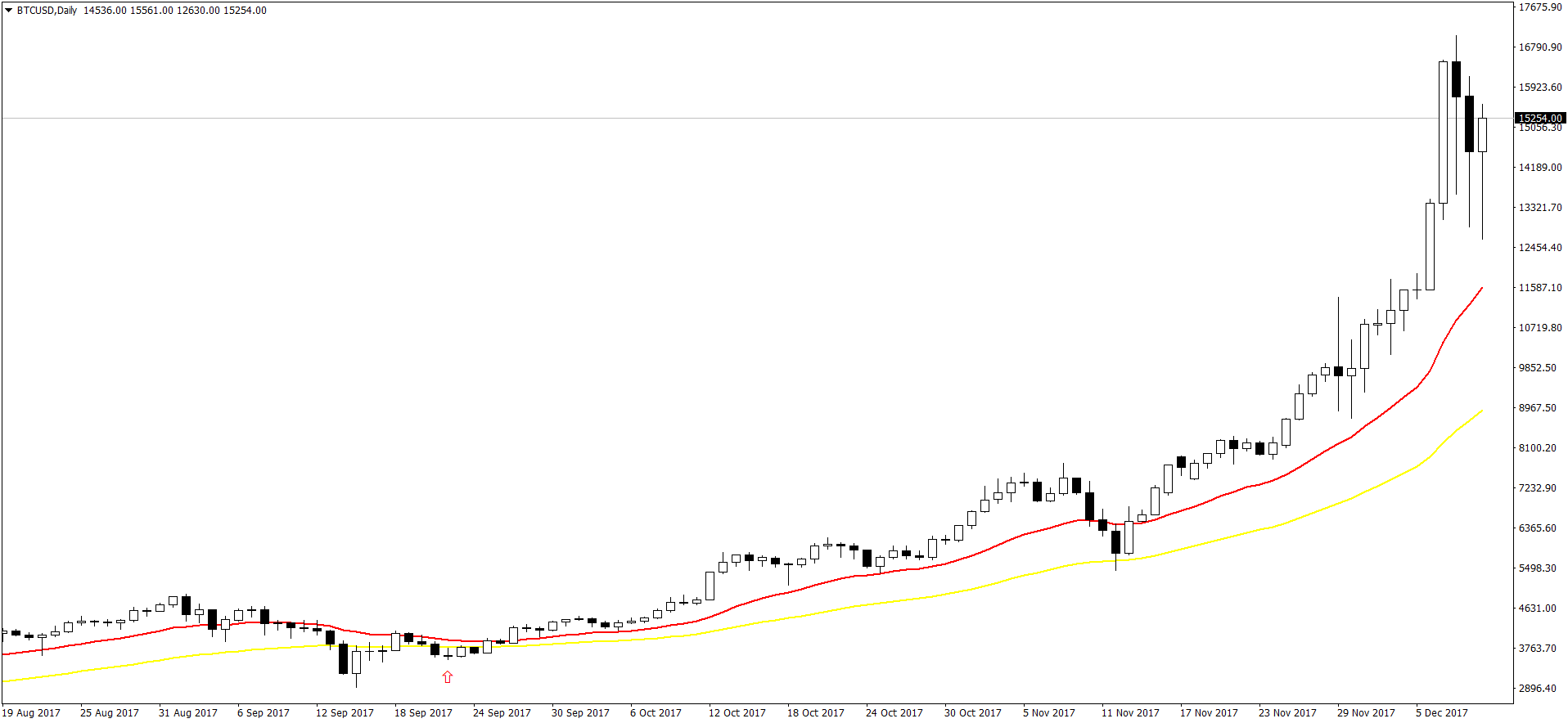

Today CNBC headline is the warning by the Deutsche Bank: Bitcoin crash is among the market’s significant risks in 2018. Bloomberg is carrying a report on the remarks made by the acting governor of the Reserve Bank of New Zealand regarding bitcoin bubble. Now many analysts think that bitcoin is a bubble that will burst and burst hard breaking many hearts. Some have even compared bitcoin mania with the tulip mania that took over Netherlands in the 17th century. When the tulip bubble had burst it made many people paupers. There is no denying the fact the bitcoin is a bubble. Take a look at the BTC/USD daily chart below. I am writing this post on Sunday and even when I am writing bitcoin price is moving violently. Right now BTC/USD is hovering around $15,270.

What do you think when you look at the above chart? Price has risen very steeply. If you have been trading for a while and have experience of reading price action, you should expect a retracement. This retracement will determine how much bitcoin can fall before it starts climbing again. Can you see the red arrow? If you had made an entry there and bought 57 bitcoins priced around $3500 on 22th September 2017. Your stop loss would have been around $50 for each bitcoin giving a total risk of around $3000. At that time 2 standard lots would have bought you these many bitcoins. You could have easily made $1 million if you had cashed in around $17,000. But how to explain this rapid rise in bitcoin prices? So much rapid rise in prices is perplexing many people as to what is happening. We have to turn to the Behavior Finance that can explain what happens when bubbles get created. This is what is happening is FOMO. Many people are calling it FOMO (Fear of Missing Out) phobia. Rising prices are attracting many people to the bitcoin market which is fueling this bubble.

I was reading an article first reported on CNBC and then picked up by Bloomberg. Winklevoss twins are now billionaires. In 2013 they had bought $11 million worth of bitcoins. Today WInklevoss twins are considered to be biggest holders of bitcoin. If you have watched an any documentary on Mark Zuckerberg you will know who these Winklevoss twins are. Both of them are of the opinion that bitcoin will appreciate 10-20 times its current value. They are making the comparison with gold. Gold is a $3 trillion market. Both think bitcoin will replace gold. I am a trader. I am not a long term investor who likes to hold on to the asset for many years. I didn’t trade bitcoin but with a standard account, you could have easily made a million dollars in around 2 months. Not bud, huh? As a trader at some point we take profit. There are many theories floating on the internet. One theory stipulates that bitcoin rise will eventually challenge US Dollar hegemony in the global markets especially in the oil market. Russia is already planning to float its own cryptocurrency for oil trading. There are around 1000 people who hold 40% of this cryptocurrency. These people are known as whales. If anyone of them decides to cash in, that can start the downward spiral that can easily snowball into a crash. So you should be watching these whales.

Bitcoin Futures Start Trading Today

Bitcoin futures have started trading today on CBOE. According to Bloomberg, almost 600 contracts were traded in the first hour of trading. With the introduction of bitcoin futures, many analysts are saying that bitcoins have gone mainstream. Introduction of bitcoin futures may help in hedging the risk in the cryptocurrency market. Volatility is a major concern for the bitcoin users. But volatility is a boone for traders. This is what gives them the potential to make massive profits. However, the Futures Industry Association is of the opinion that bitcoin futures have been rushed without given proper thought to its very high volatility. Futures Industry Association is a group of major banks, investors and traders. It is too early to make any comments as futures trading just started today. We need a few months to watch and see what happens.

The major argument made in favor of cryptocurrencies is that it is outside government control and unregulated. Bitcoin has a design limit that means only 21 million coins can be mined by the year 2140. So unlike US Dollar and EURO which can be printed in massive amounts when the Federal Reserve or the European Central Bank wants, supply of bitcoin in the market is limited. What this means is that over the long term, bitcoin is deflationary as compared to USD or EURO which are inflationary. Unregulated markets are prone to market failures. Stock market crash of 1929 is a prime example. At that time, it was thought markets don’t need any intervention. But when the stock market crashed, the only remedy was to start regulating it. At some point, bitcoin will need to be regulated. This design flaw will have to be amended. There are cryptocurrencies that have regulation by a central authority inbuilt in their architecture like Ether. The thing that interests me is what goes behind the bitcoin in terms of technology. Bitcoin is basically a peer to peer computer network that consists if:

- A decentralized peer to peer network

- A public transaction ledger which is called Blockchain

- A set of rules that validates independent transaction and currency issuance

- Proof of Work algorithm

Proof of Work Algorithm A Breakthrough

Proof of Work Algorithm is the key innovation that made bitcoin a viable currency. This algorithm elegantly solves the problem of double spending where a single coin can be spend at two or more places at the same time. Proof of Work Algorithm conducts a global election every 10 minutes allowing a consensus to be made about the state of transactions that were made in the last 10 minutes. Proof of Work Algorithm is a major innovation that solved one of the most challenging problems in distributed computing known as Byzantine General’s Problem. With Proof of Work algorithm a consensus can be reached without any central authority. This algorithm have wide applications beyond currencies. It can be used to prove fairness of elections, lotteries etc.

How To Choose A Wallet

Bitcoin Wallet is the interface to the bitcoin network. Just like you use the browser like chrome, Mozilla firefox, Microsoft edge to access the internet, you also need a wallet to access the bitcoin network. Just like the browsers, there are a number of wallets available now. Some are being actively developed and some are not. Just keep this in mind bitcoin is an open source technology. Developers are free to download the source code and do the development. End users ultimately decide which technology to use. There are desktop wallets, mobile wallets, web wallets, hardware wallets and paper wallets. It depends on the user to choose the best wallet.

Now you don’t need to really understand the technology behind bitcoins in order to trade it. If you look at the above charts, you will see it is just like any other currency chart. Reading the chart price action can give you clues what is going to happen. Did you read the post on my candlestick trading strategy that can make 200 pips with a small 20 pip stop loss. As I have said if you had opened a position with 2 standard lots, it would have bought you around 57 coins. Your stop loss would have been $50 and total risk around $3,000. You could have easily made $950K in less than 3 months. One again look at the above chart, you will see price rising too steeply in a short period of time. Price cannot rise continuously forever. In the next few weeks, you will see a major retracement when the market will try to correct itself. Uptrend will continue but after a major retracement.