Central Banks are the most important players in the currency market. If you are trading GBPUSD, you should keep a keen eye on the FED and the Bank of England while at the same time not ignoring the ECB. If you are trading EURUSD, you should keep a keen eye on the FED and the ECB.

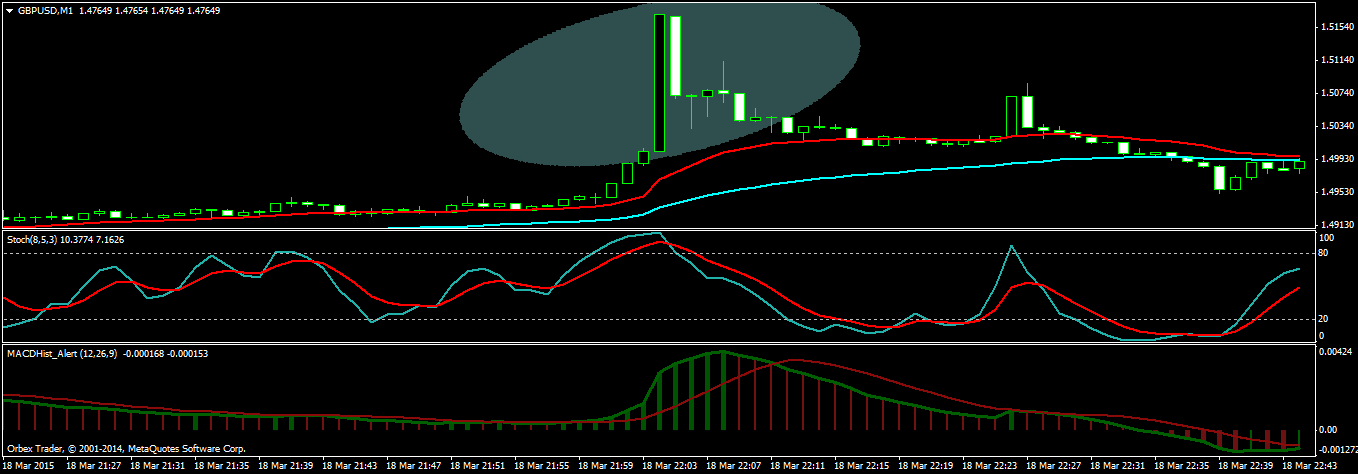

FOMC Meeting is a very important news releases event in the monthly news calender. Currency traders who trade the USD pairs like GBPUSD, EURUSD, USDJPY and others keep a careful eye on this news event that takes place every month. Market can face high volatility after this news release. If you are a news trader, you will love to trade this news release. On the other hand, if you are not a news trader you should close all your open positions before this news event and wait for the market to settle down before you reopen your positions. The recent FOMC Meeting that started on Tuesday and ended on Wednesday was watched keenly by the market analysts as they were expecting a interest rate hike by the FED in this meetings. Take a look at the following screenshot of M1 chart.

Take a look at the above 2 highlighted candles. In 1 minute GBPUSD rose 165 pips and in the very next minute it fell 100 pips. So you can well imagine the level of volatility that can result in the market after the FOMC Meeting Minutes are released. If you are not trained to trade this high level of volatility, you should avoid trading at the time of FOMC Meeting Minutes news release. This is what happened this time.

The Fed tweaked the language in its statement to show it is getting closer to launching its first rate rise in more than nine years, but Fed Chair Janet Yellen said while June is possible for the first hike, the central bank could take its time. The dollar initially reacted to the Fed’s projection for a slower path of rate increases, including expectations for a year-end fed funds rate, now projected at half the 1.125 percent it initially forecast for the end of this year.

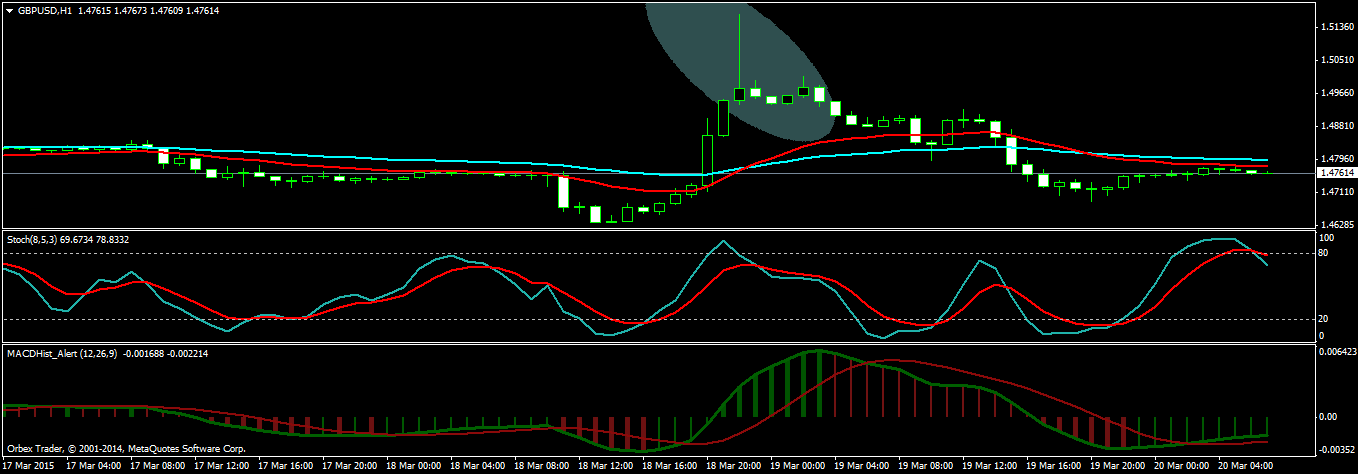

This is how we traded this FOMC Meeting Minutes news release. Take a look at the following GBPUSD H4 chart.

You can see a bullish divergence appearing on H4 a few hours before the FOMC Meeting Minute Release. Market is anticipating that the FED is not going to announce interest rate hike in this meeting. So we use H1 chart to make the entry. Take a look at the following chart.

In this chart, you can clearly see that the inverted hammer. We enter into a long trade on the 3rd candle and we get out when the price starts falling down. Always keep this in mind when the market moves too fast in one direction in a few hours, the move is not long lasting and market immediately starts a retracement that can retrace all the movement. This is precisely what happened. Initial reaction by the market was very strong in one direction. Then the reality set in. FED did not announce an interest rate increase in this meeting but said it will increase interest rates soon. So a retracement started and it continues.