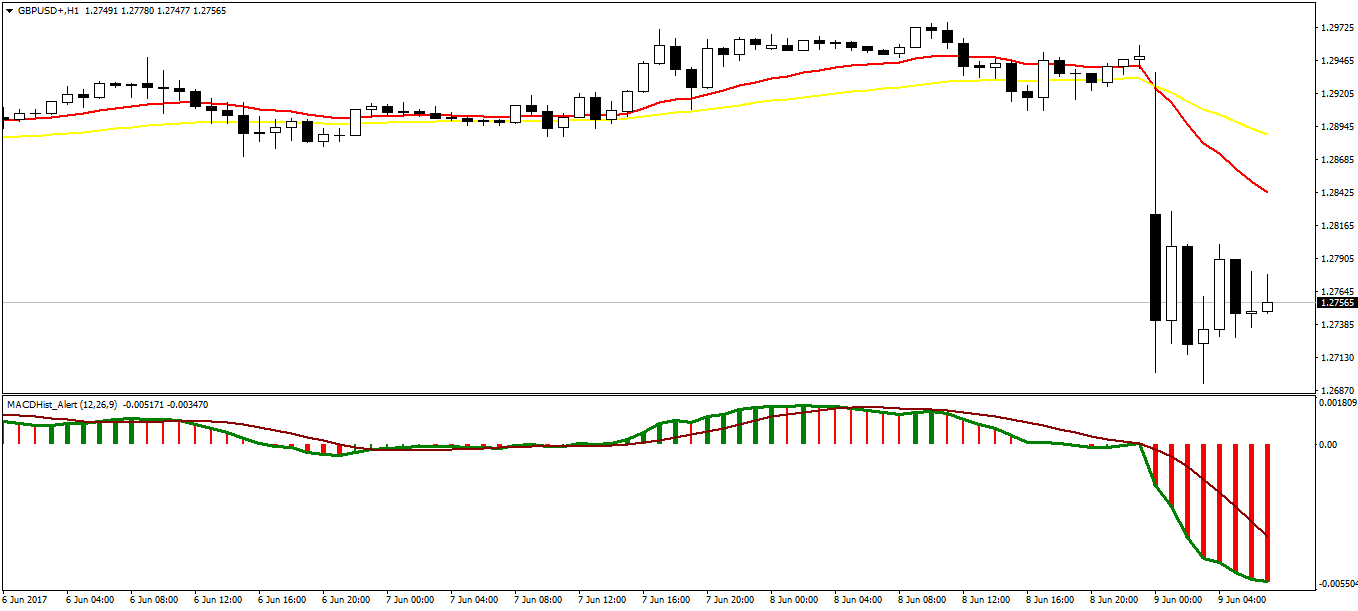

Yesterday was UK Elections. I didn’t trade yesterday due to two reasons. FBI Director Comey was scheduled to testify before US Senate. Depending on his testimony analysts were expecting a volatile day for US Dollar. Last time when President Trump fired FBI Director Comey, USD fell down. Point difference between Conservatives and Labor has narrowed down to a few points. So things were not clear. I decided to take rest on Thursday. Did you watch the documentary on the life of a millionaire forex trader. Take a look at the following screenshot of GBPUSD H1 chart below!

You can see in the above screenshot GBPUSD suddenly starts falling. This is the time when exit polls indicated that Conservative Party will fall short of a majority. Currency markets are highly sentimental. If the exit polls had indicated a win for the Conservative Party, GBPUSD would have shot up. So you never know in which direction GBPUSD will move. It is always a good idea to stay out of the market on the day of ambiguity. There are traders who love to trade naked. I am one of them. Naked trading only means trading solely based on price action without using any indicators. Indicators are all based on price and lag. Price action is what leads. So naked trading entails mastering the art of trading price action. You can watch this recorded webinar on naked trading if you haven’t done it before. lBelow is the screenshot of GBPUSD H4 chart.

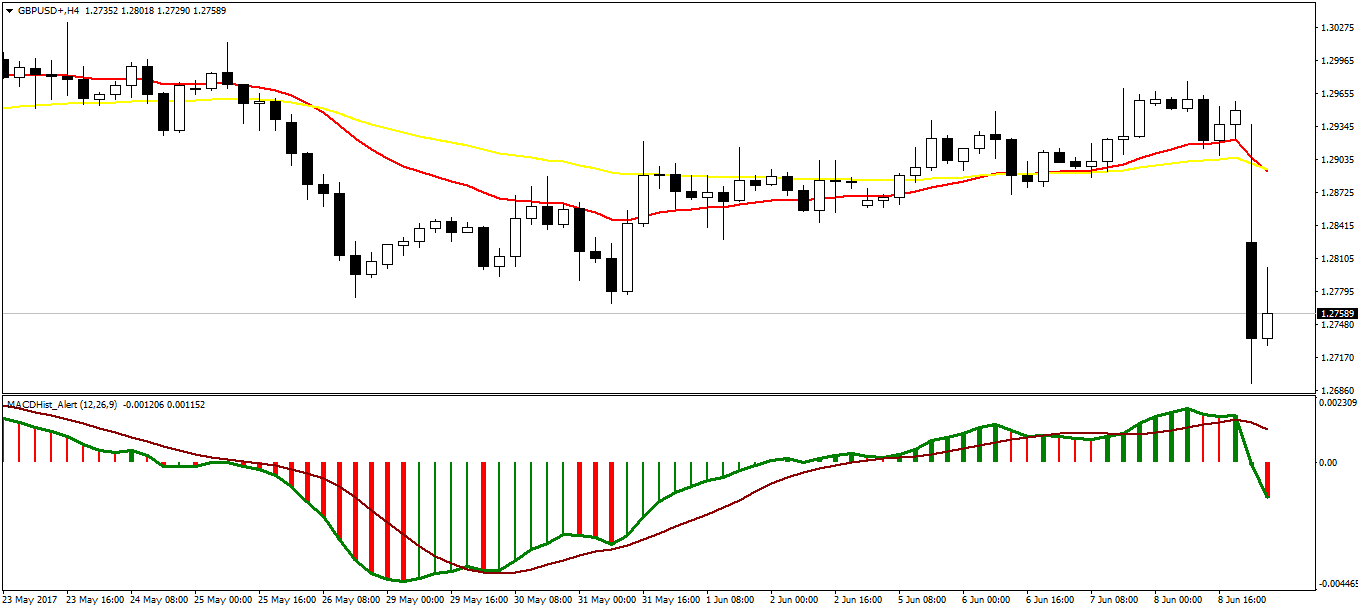

In the above screenshot, you can see that GBPUSD is waiting for election results. When exit poll results are announced that no party is going to win a majority, it fell 300 pips. So as explained above, there were 2 things that were working on Thursday. For GBP, it is the UK elections. Hung parliament will not be good. GBP will depreciate on hung parliament result. If a party emerges with a clear majority, it will be good for GBP and it will appreciate. On the other hand, FBI Director Comey testimony can weaken or strengthen US Dollar. It all depends on the testimony. If there is something in the testimony that can be used for impeachment of President Trump, it will be bad for US Dollar and it will start depreciating. So there is lot of uncertainty on Thursday. Did you download this Pin Bar Indicator?

You should understand that currency markets are highly fickle. At one point you can see the market going up and after a few minutes, you will see if falling heavily. I have been trading for many years now. I had seen the Scottish Independence Referendum. It was a close call till the last minute. Then suddenly exit polls indicated a win for the NO vote. GBPUSD immediately gaped and jumped up 300 pips. So if you had been caught on the wrong side of the market, you could have been severely burned. Brexit was another heavy day. There was no gap on that day. GBPUSD fell heavily on that day. Did you read the post on how to predict weekly candle high, low and close?

When you are trading, there is always uncertainty. There is no way you can predict the market 100%. So it is always a good idea to stay away from the market on the day of uncertainty. This is what I did. Now as I said before, naked trading is a powerful tool in the hands of experienced traders. Candlestick patterns are important tools in naked trading. Candlestick patterns are very important when it comes to determining the sentiment in the market. You can read this post on my candlestick trading strategy. My candlestick trading strategy entails catching the big moves in the market with a small stop loss. This means most of the time I love to make 100-200 pips with a small 10-20 pip stop loss.

It is a good idea to trade a number of pairs. EURUSD, GBPUSD, USDJPY, AUDUSD, NZDUSD etc are great pairs. Many traders however miss trading exotic pairs. Trading exotic pairs can be highly profitable. Read the post on USDSEK long trade that made 2000 pips profit with a small 26 pip stop loss. Sticking with one pair is not a good idea. As said, some days are too uncertain. You never know in which direction that pair will move. Trading a number of pairs like 10-20 can give you much more opportunity. First let the trend develop and then open the trade in the direction of the trend.

Never try to identify the top or bottom. I have done that and most of the time suffered a lost. Then I learned with experience that first let the new trend to develop and then trade in that direction. We should wait for market to close today. If the weekly candle closed as bearish that will mean a downtrend on GBPUSD that we can trade next week. So always be patient when it comes to trading. You must have understood by now currency market is swayed a lot by the political and economic events in the country. UK Election results are not good. It means GBPUSD will fall more next week. You can trade GBPUSD next week with a lot less risk as compared to trading GBPUSD on Thursday. Read the post on a GBPUSD swing trade that made 76% return in 2 days.

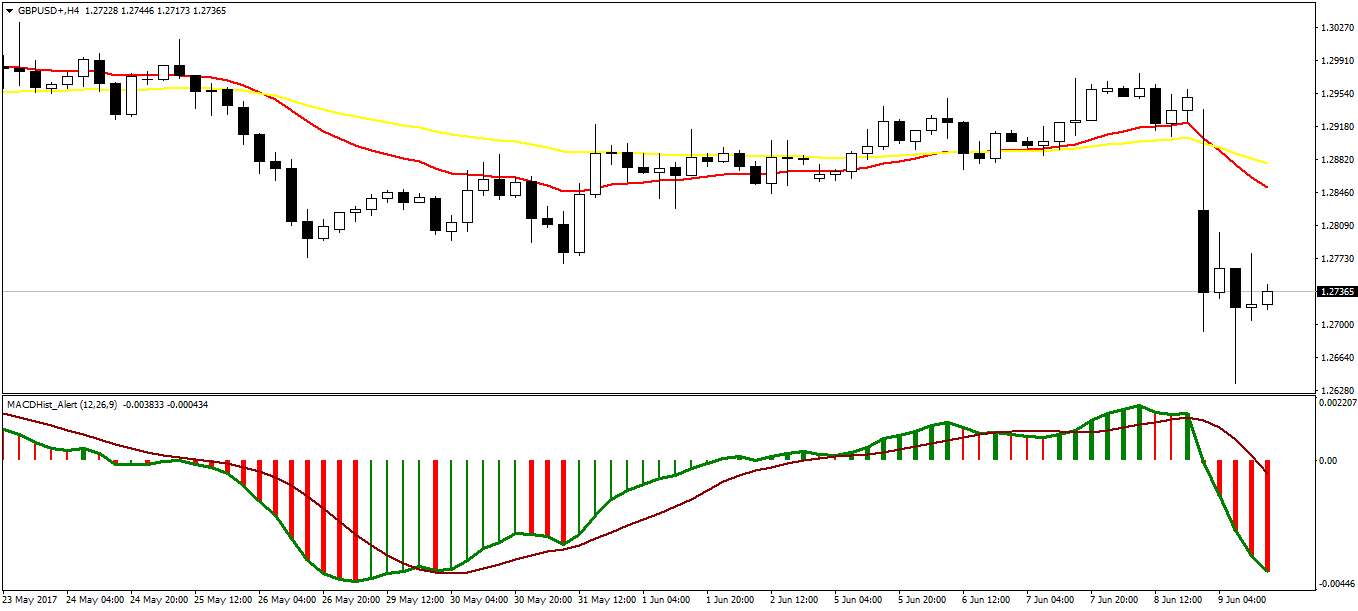

Algorithmic trading is on the rise. Today algorithms are trading the markets. More than 80% of the trades that are being placed on Wall Street are by algorithms. Soon you will find it too difficult to trade against these algorithms. It is becoming more and more difficult to beat these algorithms. Did you notice this that traditional indicators like MACD, Stochastic, RSI etc don’t work now. Most of the time these indicators give false signals. Neural Networks are one way to predict the market. You can take a look at my course Neural Networks for Traders. Trading is becoming more and more sophisticated. In this course on Neural Networks for Traders, I show you how you can use them in actual trading. Last thought before I close this post. GBPUSD is a highly volatile pair. Always take risk management very serious when you trade this pair. This pair can suddenly change direction. So always be careful when you trade GBPUSD. After 10 hours I checked and this is the new GBPUSD H4 chart.

GBPUSD was rattled in the start by the uncertain outcome of UK elections. But after a few hours things have become more certain. Theresa May has announced that she will form a minority government with the help of DUP. In the above chart, you can see GBPUSD has started rebounding now. This is what I have been saying. Markets are highly fickle. At one moment you will see it going full steam in one direction and after a few hours you will see it moving full steam in the opposite direction.Next week will bring new realities. GBPUSD can rebound fully from the UK election hangover. GBPUSD can continue to fall if over the weekend things again become uncertain. After all Theresa May has failed miserably in her gamble.

Regarding former FBI Director Comey testimony, there is a lot of news that the market absorbs. Why would the market care about Comey testimony? You cannot predict before hand. Only afterwards we can say it did matter or it didn’t matter. Most of the information about Comey is already available publicly. So market has already priced that information in. Only in case of a surprise that can rattle the market we should expect a big reaction. President Trump has been surprising the currency market a lot and we have seen the currency market reacting wildly whenever he had spoken. US Dollar had slipped when Trump fired Comey on May 10th. Trump had surprised the market. This time there will be no surprise. This is precisely what happened. Market didn’t react much.

What rattles the market is surprise. We cannot predict surprises. This is what makes predicting the markets a difficult job. Looking at candlestick patterns can give you a glimpse of what the market sentiment is. But keep this in mind. Markets are highly dynamic and you should not take things easy. Any moment, market can change direction. So always be on the alert when trading the currency market and especially currency pairs like GBPUSD. Take risk management very seriously. Don’t risk too much. Risking too much on one big home run is what destroys most of the traders.